As the pandemic ravages the hospitality industry across the country, forcing hotels to close and lay off thousands in the Austin area alone, at least one Austin-based real estate investment company sees opportunity.

SHIR Capital is shifting from buying apartment complexes with value-add opportunities to buying hotels that it can convert into affordable, micro-unit apartments. The company seeks to buy 10 to 20 hotels in prime areas across the country. It’s a niche that SHIR Capital tapped into prior to the pandemic, but one that could grow within the next six months to two years as more hotel loans go into default due to the downturn in travel.

“Coronavirus comes then hotels take a huge hit, and now it is our primary focus,” said Elan Gordon, principal of SHIR Capital. “It is where the deals make sense for us, price point wise. On top of that, if it is in the right area it often makes sense.” This strategy will also add hundreds if not thousands of much-needed affordable apartment units — renting at around $800 a month — to Austin, he said.

The city of Austin is also buying and leasing declining or closed hotels to serve as homeless and domestic violence shelters.

Charles Cirar, vice chairman at CBRE Group Inc. specializing in multifamily, said his office has been fielding calls from investors looking for similar opportunities amid the pandemic. “We believe this redevelopment strategy has considerable potential, but also see it as a limited niche play that will likely not have a significant impact on either the overall hospitality or multifamily markets,” he said. Investors are targeting limited-service hotels that they could buy for between $20,000 and $30,000 per room key, Cirar said.

Gordon said his company has partnered with funds on both the debt and equity side to acquire hotel properties on a “price per pound” based on the number of units rather than based on its net operating income since these properties aren’t generating much if any revenue right now. Many hoteliers are looking to get out of the business because it may take a few years for revenue to rebound, he said. Others are delinquent on their mortgage and want to sell before the bank takes the property.

Gordon said his company is calling hotels along I-35 and tracking hotels that have loans that are maturing or defaulting. They are also buying hotel loans and picking up properties on the auction block.

Because of the strength of the Austin economy, Cirar said he doubts whether a large volume of hotels would be sold at the price level needed for these apartment conversions in Austin. In many cases, the underlying value of the land would offer greater potential for new multifamily development, particularly in more infill locations, he said.

Potential pitfalls for projects of this type are obtaining financing for the conversion and making costly mistakes in the renovations, he said. Joe Dowdle, senior director of multi-housing advisory at Jones Lang LaSalle Capital Markets, agreed that hotel conversions could be a short-term niche.

He said investors face many challenges as hotels can generate more revenue by renting rooms at a nightly rate versus a monthly apartment rental rate, and many hotels are encumbered by franchise agreements that could last 15 to 20 years. Termination of these agreements could mean substantial fees.

When looking for potential hotel properties to redevelop, Cirar said investors should look for what they would in a new development site such as visibility and safe ingress/egress from well-traveled roads, walkability to conveniences, access to entertainment and recreation and parks, proximity to employers, and desirable schools and neighborhoods. “Many existing hotel properties in Austin, both urban/infill and suburban, do check all or most of these boxes,” he said.

Austin Projects

SHIR Capital’s first Austin hotel conversion is at the former Austin Suites Hotel at 8300 N. I-35 that it bought from Artesia Real Estate in March. Artesia had bought the closed hotel in 2018 with the plan of transforming the 215 rooms into apartments.

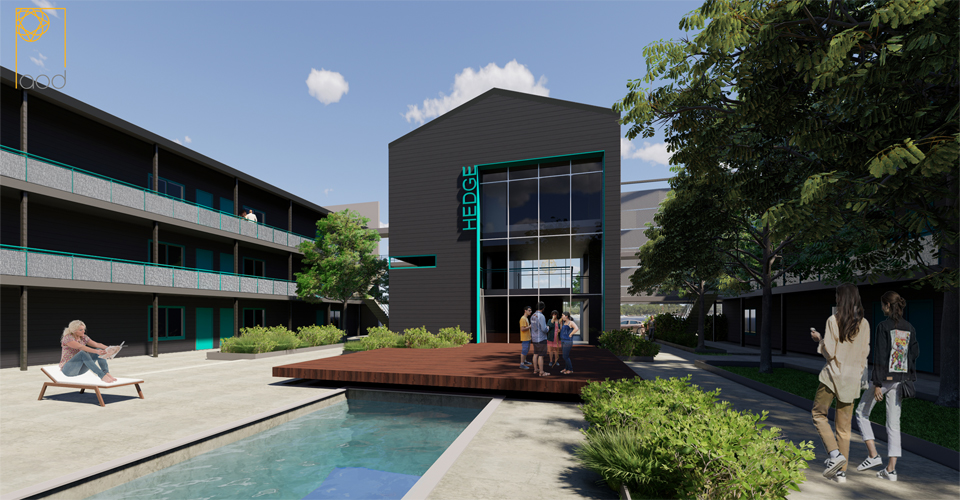

According to its website, SHIR Capital bought the property for $9.5 million and plans to invest about the same amount in improvements. Travis Central Appraisal District values the property for tax purposes at $6 million. The process of renovating the extended stay hotel, now dubbed The Hedge, has begun and some tenants will even be moving in soon, Gordon said. The pool, fitness center and other amenities are being updated as well as SHIR seeks a mixed-use overlay zoning from the city for the property and works to bring the property up to code. Austin Outdoor Design is working on the project.

All units at The Hedge will be studio apartments of about 275 square feet each. They are leasing for about $750, but Gordon said he expects that price to rise because of early demand. Other studio apartments in the area such as Orbit, Starburst and Centro are leasing for more, between $800 and nearly $1,000 a month.

Prior to this project,

SHIR Capital has done similar ones in Philadelphia and South Carolina. It’s under contract to buy two more hotels along I-35 in Austin. Gordon declined to name those properties.

SHIR Capital is a vertically integrated real estate investment group with 2,200 apartment units in Texas, South Carolina and Pennsylvania.

Erin Edgemon

Staff Writer

Austin Business Journal

https://www.bizjournals.com/austin/news/2020/07/23/austin-real-estate-hotels-apartments.html